Lumentum Holdings Inc. and Coherent, Inc. today announced that they have entered into a definitive agreement under which Lumentum will acquire Coherent in a cash and stock transaction valued at $5.7 billion. Under the terms of the agreement, which has been unanimously approved by the Boards of Directors of both companies, Coherent stockholders will receive $100.00 per share in cash and 1.1851 shares of Lumentum common stock for each Coherent share they own. At closing, Coherent stockholders are expected to own approximately 27% percent of the combined company.

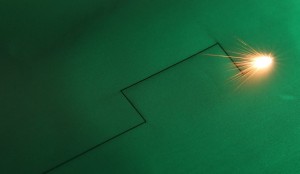

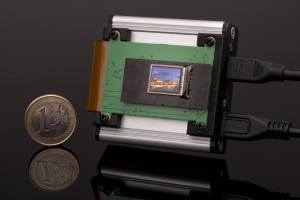

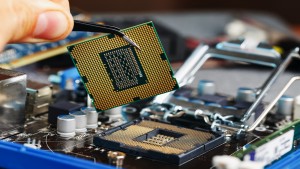

The combination unites Coherent's leading photonics and lasers businesses, including in the Microelectronics, Precision Manufacturing, Instrumentation, and Aerospace & Defense markets, with Lumentum's leading Telecom, Datacom, and 3D Sensing photonics businesses, creating a diversified photonics technology company with significantly increased scale and market reach. The combination accelerates Lumentum's penetration of the more than $10 billion market for lasers and photonics outside of the communications and 3D sensing applications. The powerful R&D engine of the combined company will be primed to accelerate innovation in existing and future markets that need the unique capabilities that photonics bring. The combined company will be better positioned to serve the needs of a global customer base increasingly dependent on photonics to enable important end-market transitions including the shift to digital and virtual approaches to work and life, the transition to 5G in wireless networking, advanced bioinstrumentation, advanced microelectronics, and new materials for next generation consumer electronic devices, flat panel and OLED displays, communications equipment, electric and autonomous vehicles, and energy storage.

Compelling strategic and financial benefits

- Creates Diversified Industry Leader by Combining Complementary Leadership Positions Across Key Photonics Markets: The combination will create a leading photonics company with significant positions in the growing market for photonics, an expansive global customer base and a well-diversified revenue mix. By bringing together Coherent's world-class photonic solutions across the microelectronics, precision manufacturing, instrumentation, and aerospace & defense markets with Lumentum's leading photonic solutions for the Telecom, Datacom, and 3D Sensing markets, the combined company will offer a broad, differentiated portfolio of photonics products and technology in diverse, growing end markets. The combination accelerates Lumentum's exposure and penetration of the more than $10 billion market for lasers and photonics outside of communications and 3D sensing applications where Lumentum has existing leadership positions.

- Creates Stronger Partner for Customers: Lumentum is committed to the photonics and lasers markets and to strongly investing in innovation and manufacturing capabilities to deliver on customers' photonics needs, today and into the future. The combined company will have a larger global footprint and a broader portfolio of products and technology relevant to global leaders in the development and manufacturing of semiconductors, microelectronics, consumer electronics, autonomous and electric vehicles, and cloud and communications networks, which increasingly need a broader array of photonic solutions for their multitude of product, infrastructure, and manufacturing needs.

- Increased Intersection of Value Chains Driven by Long-Term Trends: Photonics will play an increasing role in the accelerating shift to increasingly digital and virtual approaches to work and daily life, addressing climate change, new approaches to health care and monitoring, and addressing new safety and security. Combining Lumentum's and Coherent's products and technologies increases the intersection of the value chains for all of these applications, from the photonics used to discover, develop, and advance these applications, to the photonics that enable high precision manufacturing to create the high value goods needed in these applications, to finally the photonics products that are directly used in these applications.

- Well-Positioned to Pursue Attractive Growth Opportunities and New Markets and Expand Position in Technology Stacks: The combined organization will be well-positioned to pursue catalysts for future growth and drive new market opportunities from conception to volume deployment due to its increased capabilities and resources, powerful combined R&D engine, track record of customer-centric innovation, and strong customer relationships. The combination's increased vertical integration, from underlying components and materials to sub-systems and systems, allows an accelerated optimization of the combined company's participation in the technology stack of end market customers.

- Delivers Substantial Run-Rate Synergies and Solid Accretion to Lumentum's Earnings: There are significant efficiency gains in combining derived by the increased scale, reducing redundancies, and leveraging the best capabilities in the combination. The combined company is expected to generate more than $150 million in annual run-rate synergies within 24 months of the closing of the transaction. The transaction is expected to be accretive to the combined company's non-GAAP earnings per share during the first full year after the close of the transaction. Upon closing, the combined company is expected to have a solid balance sheet and strong operating cash flows, creating substantial financial flexibility to pursue continued growth initiatives.

Transaction terms, Financing, governance and approvals

The transaction value represents a premium of 49% to Coherent's closing price on January 15, 2021.

Lumentum intends to finance the cash consideration of the transaction through a combination of cash on hand from the combined company's balance sheet and $2.1 billion in new debt financing from a fully committed Term Loan B.

Two members of the Coherent Board will be appointed to the Lumentum Board, which will be expanded to nine directors, at the closing of the transaction.

The transaction is expected to close in the second half of calendar year 2021, subject to approval by Lumentum's and Coherent's stockholders, receipt of regulatory approvals and other customary closing conditions.

Conference call

The companies will hold a conference call today, January 19, 2021 at 5:30 a.m. PT/8:30 a.m. ET to discuss today's announcement. A live webcast of the call and the replay will be available on the Lumentum website at http://investor.lumentum.com. Supporting materials for the call's presentation will be posted on http://investor.lumentum.com under the "Events and Presentations" section prior to the call and on http://investors.coherent.com.

A conference call replay will be available through January 26, 2021, at 11:59 p.m. ET. To listen to the live conference call, dial (844) 802-2439 or (412) 902-4275 and reference the passcode 10151718. To access the replay, dial (877) 344-7529 or (412) 317-0088 and reference the passcode 10151718.

Back to News

Back to News