The North American robotics industry continued to build momentum in the first half of 2025. New data from the Association for Advancing Automation (A3) shows robot orders increased by 4.3% and revenue rose 7.5% compared to the first half of 2024, a promising sign for continued automation investment amid a complex economic landscape.

Automotive Leads First-Half Gains, with Support from Life Sciences and Plastics

North American companies ordered 17,635 robots valued at $1.094 billion in the first six months of 2025. Automotive OEMS led industry growth with a 34% year-over-year increase in units ordered. Other top-performing segments included plastics and rubber (+9%) and life sciences/pharma/biomed (+8%), reflecting broader trends like reshoring, labor shortages, and the push for greater operational efficiency.

Life Sciences and Electronics Drive Q2 Growth

In Q2 alone, companies ordered 8,571 robots worth $513 million, marking a 9.0% increase in units over Q2 2024. Life sciences/pharma/biomed posted the strongest sector growth in the quarter (+22%), followed by semiconductors/electronics/photonics (+18%) and steady gains in plastics, automotive components, and general industry.

“The continued growth in robot orders underscores what we’ve been hearing from our members: automation is now central to long-term business strategy,” said Alex Shikany, Executive Vice President at A3. “It’s not just about efficiency anymore. It’s about building resilience, improving flexibility, and staying competitive in a rapidly changing global market. If these patterns hold, the North American robotics market could outperform 2024 levels by mid-single digit growth rates by the end of the year.”

Collaborative Robots Show Rising Influence

Collaborative robots (cobots) accounted for a growing share of the market with 3,085 units ordered in the first half of 2025, valued at $114 million. In Q2 alone, cobots made up 23.7% of all units and 14.7% of revenue. These systems are increasingly favored for their ability to work safely alongside humans and address automation needs in space- or labor-constrained environments. A3 began tracking cobots as a distinct category in 1Q 2025 and plans to expand future reporting to include growth trends by sector.

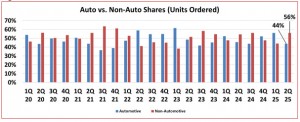

Automotive vs. Non-Automotive Sectors in Q2

The non-automotive sector took the lead over automotive in Q2, accounting for 56% of total units ordered. This move reflects the expanding role of automation in industries such as life sciences, electronics, and other non-automotive manufacturing sectors.

More detailed market breakouts and graphs from the Q2 2025 report are available upon request for press and within the A3 Vault for member companies.

Back to News

Back to News