Machine vision is an integral part of automation, and European suppliers are amongst the leaders in providing image processing technology. Rationalization, increase in productivity, shorter lead times, faster cycle times and high quality requirements, together with ever new application areas offer opportunities for growth in machine vision in the future.

The annual industry study European Vision Technology Market Statistics 2012 published by the European Machine Vision Association provides an insight view about sales numbers, markets and technological trends.

Key markets in Europe

Germany is the largest market for machine vision production and applications in Europe. However, other countries in Europe host a vivid machine vision industry, as the EMVA-study shows in its “country reports” on Italy, France, the UK and Benelux. Interestingly, all these markets have developed special characteristics according to the needs of the dominating domestic customer industries. While the automotive and machine building industries still are the major customer sectors for machine vision suppliers in Germany, in France the aeronautic and avionic sector, together with the military and defense sector play a much larger role. The machine vision companies in these two markets, together with their colleagues in Italy, do have their own production of vision components such as cameras or frame grabbers and a notable export share of vision products. Both characteristics are far less distinctive in the UK machine vision industry, which is very much dependent on exports and concentrates on the British market with its machine vision system solutions.

Industrial customers remain investment-friendly

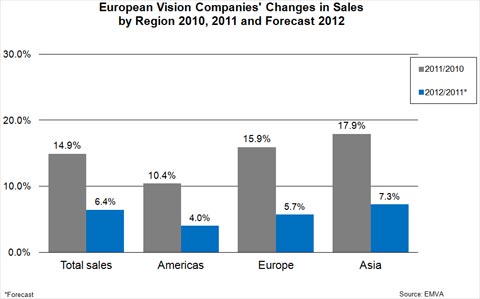

Compared to the previous year, total turnover of the machine vision industry in Europe grew by just under 15% in 2011, according to the report. With close to 1.5 billion Euro recorded turnover the machine vision companies in Europe set a new sales record. Geographically, the strongest growth was realized in sales to Asia, where 22% of all sales were generated last year. Also sales within Europe and to the Americas grew double-digit in 2011. With an almost 64% share of total turnover, the study shows that Europe still is by far the largest market for the European machine vision companies.

Compared to the previous year, total turnover of the machine vision industry in Europe grew by just under 15% in 2011.

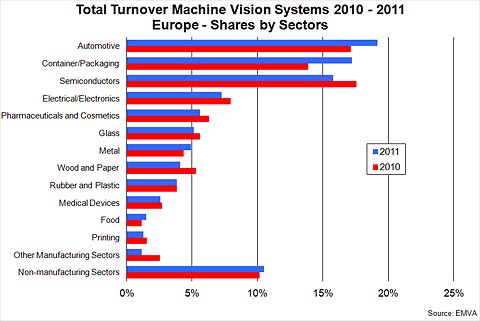

According to the report, the worldwide economic upswing last year and along with it the increase in industrial production has led to a strong increase in demand for machine vision technology from the traditional clientele out of the industrial manufacturing sector. Not only this: Machine vision systems turnover to all non-industrial customer segments even increased above average by 24% (see figure 1 below).

Products and applications

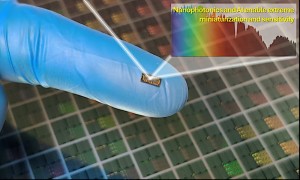

Inspection of piece parts remained the dominating application of machine vision in 2011 according to the market analysis, and they are far ahead of other applications, such as continuous inspection of web material, 2D and 3D metrology and robot guidance.

Inspection of piece parts remained the dominating application of machine vision in 2011.

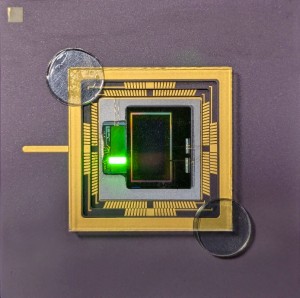

Other than expected by the market analysts, the demand for complex, sophisticated and therefore expensive vision systems remained high, which is why the product group of smart cameras/compact systems/vision sensors only marginally increased its share of total turnover. In the product group of vision components, cameras remained the dominating driver of turnover with a close to 28% share of total turnover last year. Frame grabbers were the only product type shown separately in 2011 which experienced a decline in sales that ranged in the medium single-digit area.

Benelux is key high-tech region in Europe

With the focus on Benelux, this year for the first time an EMVA country-specific report not only covers the machine vision industry in one single country, but in a region that is formed by three independent EU members. The study’s findings show a dynamic machine vision market with a total market volume of just under 300 million Euros within an extremely technologically sophisticated region. Thus, the report comes to the conclusion that such a combined vision competence in all disciplines from manufacture through research to various industrial and non-industrial applications, concentrated on such a limited geographical area, would be difficult to find anywhere else in Europe.

Trends in machine vision

A major trend the report uncovers is that challenges for machine vision technology and development are changing. The trend for improvement (faster, cheaper, more precise, more robust), which is still valid e.g., in piece part inspection, will give way to more integrated, simpler and more automated solutions. For industrial applications, the machine vision sector more and more follows the customer demand for complete solutions. The trend for specialist suppliers for specific industries/sectors with products adapted to these markets continues to spread, according to the EMVA report. This implies the seamless integration of the machine vision systems from the very start of the planning process of a production facility. At the same time the market for general-purpose systems distributed via traders (as opposed to system integrators) is on the rise. 3D technologies are gaining importance; in particular 3D guided robots are seen to be a great opportunity for machine vision companies to remain a driver for the 3D technology.

Economic forecast

As the world economy currently shows clears signs of a cooling down, the EMVA survey expects that this will have an effect on the European machine vision industry as well. In addition, the lasting debt crisis in the Euro area leads to economic uncertainties. Still, the long term trend toward further automation will continue and even accelerate in economies with an emerging industrial production, such as India and South America. Furthermore, because the fields of application for machine vision technology are virtually unlimited, the report expects that the application of vision technology in completely new areas outside the industrial production offers even more possibilities for this industry to prosper and even now is making a significant contribution to total sales of the industry.

The application of vision technology in completely new areas outside the industrial production offers even more possibilities for this industry to prosper.

Overall, the industry is expected to grow again in the course of this year in the most important regions Europe, Asia and the Americas, but no longer with double-digit rates. The European Machine Vision Association predicts that total turnover of machine vision in Europe will close the year 2012 with an increase of 6.4%. (See figure 2).

Written by Andreas Breyer, Senior Editor, Germany, Novus Light Technologies Today

Back to Features

Back to Features