- Strategic combination expected to drive significant value creation through increased scale, broadened technological base, complementary product roadmaps and leadership positions in fast-growing markets

- $150 million of expected run-rate cost synergies realized within 36 months of close

- Transaction expected to drive accretion in Non-GAAP earnings per share for the first full year post close of approximately 10% and more than double that thereafter

- II-VI and Finisar to host conference call today at 8:00 a.m. EST to discuss transaction

II-VI Incorporated, a global provider of engineered materials and optoelectronic components, and Finisar Corporation, a global technology specialist in optical communications, have announced that they have entered into a definitive merger agreement under which II-VI will acquire Finisar in a cash and stock transaction with an equity value of approximately $3.2 billion.

Under the terms of the merger agreement, which has been unanimously approved by the Boards of Directors of both companies, Finisar’s stockholders will receive, on a pro-rated basis, $15.60 per share in cash and 0.2218x shares of II-VI common stock, valued at $10.40 per share based on the closing price of II-VI’s common stock of $46.88 on 8 November 2018. The transaction values Finisar at $26.00 per share, or approximately $3.2 billion in equity value, and represents a premium of 37.7% to Finisar’s closing price on 8 November 2018. Finisar shareholders would own approximately 31% of the combined company.

The combination of II-VI and Finisar would unite two companies with complementary capabilities and cultures to form a photonics and compound semiconductor company capable of serving the broad set of fast growing markets of communications, consumer electronics, military, industrial processing lasers, automotive semiconductor equipment and life sciences. Together, II-VI and Finisar will employ over 24000 associates in 70 locations worldwide upon closing of the transaction.

Strategic rationale

As a combined company, II-VI and Finisar will continue to leverage their innovation and commercialization of complex technologies to maximize value through vertical integration and manufacturing scale. The core competencies will complement each other at all levels, including in the following strategic areas:

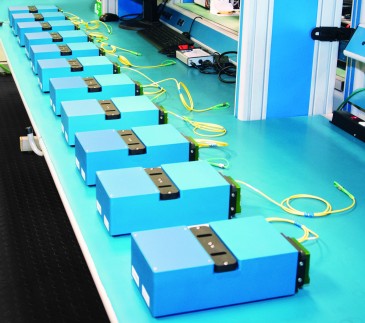

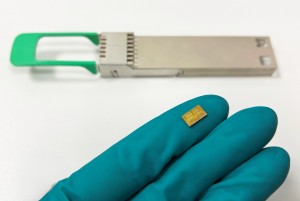

Optical Communications: The combined company will provide a full line and scalable supply of high-performance Datacom transceivers, products based on coherent transmission technology and ROADM solutions. It will market products into next-generation undersea, long-haul and metro networks, hyperscale datacenters and in 5G optical infrastructure.

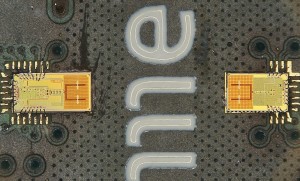

Platform for 3D sensing and lidar: The combined optoelectronics technology expertise based on GaAs and InP compound semiconductor laser design platforms, together with the 6-inch vertically integrated epitaxial growth and device fabrication manufacturing platforms, will enable faster time-to-market for opportunities in 3D sensing and lidar.

Combined capabilities unlock access to larger markets: The portfolio of differentiated engineered materials, including GaAs, InP, SiC, GaN and diamond, together with optoelectronic, optical and integrated circuit device design expertise and related intellectual property, will unlock access to larger markets in RF devices for next-generation wireless and military applications as well as power electronics for electric cars and green energy.

Vertical integration: Vertical integration of core technologies ranging from engineered materials to high value-add solutions, enabled by differentiated components, will provide the combined company with a foundation to capitalize on emerging opportunities.

Financial performance

In addition to the strategic benefits, the combination of II-VI and Finisar will:

- Accelerate revenue growth: On a pro-forma basis, the combined company had approximately $2.5 billion of annual revenue. The combined broad base of talent, technology and manufacturing is expected to enhance the ability to better address near-to medium-term opportunities and accelerate revenue growth.

- Synergy potential: The combined company expects to realize $150 million of run-rate cost synergies within 36 months of closing. Synergies are expected to be achieved from procurement savings, internal supply of materials and components, efficient research and development, consolidation of overlapping costs and sales and marketing efficiencies.

- Earnings accretion: The transaction is expected to drive accretion in Non-GAAP earnings per share for the first full year post close of approximately 10% and more than double that thereafter.

Transaction Details

II-VI intends to fund the cash consideration with a combination of cash on hand from the combined companies’ balance sheets and $2 billion in funded debt financing. The transaction is expected to close in the middle of calendar year 2019, subject to approval by each company’s shareholders, antitrust regulatory approvals and other customary closing conditions.

Management and Board of Directors

Upon closing of the transaction, Dr Mattera will continue to serve as President and CEO of the combined company.

In addition, in connection with the closing of the transaction, three Finisar board members will be appointed to the II-VI Board, which will be expanded to 11 directors.

Back to News

Back to News