In this article, Carlos Lee, EPIC’s Director General, talks to Jean-Christophe Eloy, President and CEO of Yole Group, an international company specialising in the analysis of markets, technological developments, supply chains and the strategy of key players in the semiconductor, photonic and electronic sectors.

You have said that the semiconductor industry is in a strange phase at the moment and that photonics activity is booming. Can you summarise the industry’s state of play today?

Looking at the companies that are reporting 2022 financial data, the year was exceptional in terms of size of the business, sales, and profitability. There are a few exceptions, such as memory where there were price decreases in the second half of the year but other than that, 2022 was just incredible. It was a year of 5% growth (excluding the memory market), following three years of growth.

And this will continue in '23, '24. There will be two quarters of decreasing business, as always when there is an impact on demand compared to production, but the restart will happen Q3, Q4 this year.

There is more semiconductor content in everything. Even of mobile phone units are low, the value of semiconductors in cars has multiplied almost 10-fold. The long term trends of the semiconductor industries are growth, with more production and more complexity, coupled with a supply chain that needs to be diversified because of the tension between China, Taiwan and the USA.

Looking to the long term, in the next 10 years, there are signs of super-high growth. There has been talk that the equipment business will decrease by 12% in 2023 compared to 2022 but they “forget” to mention that 2023 will be the second best year ever in terms of business. While it is decreasing 15% compared to 2022, last year was so high that it would be unsustainable to remain at that level of activity.

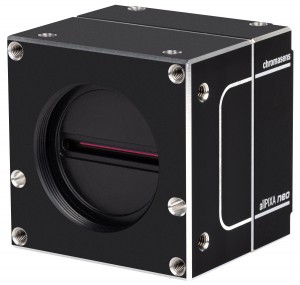

With regard to the photonics industry, 10 / 15 years ago we were talking about LEDs, small volume production device but now photonics is entering the data center market with silicon photonics. Today, there will be five image sensors in each mobile phone, almost 10 cameras in cars, there is lighting and LEDs everywhere. In the cycle of light, for telecoms, optical telecoms and data centers, there are lenses that shape the light in the emission and reception and also an image sensor or detector.

This is a huge, huge business, hundreds of billions of dollars today. It's quite fragmented because there is no one technology for photonics, but its impact is huge.

Here, EPIC has a unique position to highlight the importance of the photonics industry worldwide. Its 800 members across the globe demonstrate that this industry is not homogenous, it has laser makers, LED makers, image sensor makers, infrared sensor manufacturers, lens makers. As well as fragmented it is growing extremely fast.

The industry needs a voice for the jet fighters, airplanes, trains, cars, mobile phones, washing machine and so on. Just as there is a diffusion of semiconductor devices in day-to-day life from military to consumer application, it is the same for photonics.

Would you say the market position of photonics is parallel to the semiconductor industry?

Yes, it's parallel because last year the semiconductor business was worth something like $600 billion, but the photonic part, from emission - LEDs, lasers - to the reception of light, including the lenses, is more than $100 billion.

It is as important as the semiconductor business because of this diffusion ranging from military, security to consumer, industrial to medical.

Everybody's talking about the semiconductor market growing to $100,000 million (one trillion dollars) in the next 5-7 years, but the photonics market is more than $100 billion and moving to $300 billion at the end of the decade but because it's so fragmented that there is no aggregation of the data. At Yole Group, we are aggregating the data.

Is the miniaturization trend that we see in the semiconductor industry, also parallel for the photonics industry?

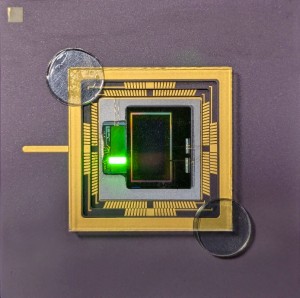

A long time ago, the industry began to combine sensors, image sensors, detectors for medical applications, for mobile phones and military equipment and so on into equipment the size of a shoebox. Silicon meant the package size shrank to the size of a matchbox. This, together with decreased cost due to volume production, opens up markets and enables better performance. This is a huge driver.

We are at an important intersection; on one side are lenses, very complex systems, and on the other are semiconductors which enable miniaturization, the ability to reduce cost and increase performance. We are reaching a point where there are a lot of companies mastering this miniaturization of photonics.

There are a lot of opportunities driving growth in the photonics industry in the next 10 years, because when you decrease the price, you increase the number of units and innovation is diffused. We are seeing this at the moment in light emission, light reception and lenses, shipping the light to silicon on packages for ease of integration.

Everybody is impacted positively or negatively by this development and they have to move fast in order to be able to make this key change in the industry. Which is where EPIC helps manufacturers to follow or standardize these trends.

What business opportunities are there as a result of this miniaturization?

Moving from shoebox-sized systems that were complex to assemble, test, and manufacture, to system in package or system in silicon simplifies production, enables a reduction in production costs.

Are there new players entering the industry?

It's rather a case of existing companies developing their activities. These include ST, OSRAM-ams. Interestingly, the acquisition of ams combines the detector and lighting emission industries. There is also II-VI and Lumentum. Players are growing through organic growth or acquisition and there is a lot of acquisition in order to consolidate this industry.

New technologies players are emerging but these are bought by bigger companies which can use the existing infrastructure and not have to rebuild everything.

Why is photonics important today?

It is important on two levels. Having five image sensors in a mobile phone, for example, will create better selfies, or you can track your environment using AR. These are nice to have, but not life-changing.

There are also life-saving medical and military applications. For example, imaging which enhances human capabilities in these areas. The ability to emit and reset light and to analyze this light is vital in medical, military and security applications.

It allows clinicians to use precise light, focused on key body parts, instead of using radiation that is harmful in tumour treatments, for example, or the ability to detect skin or internal issues early using light emission.

Other companies are developing sophisticate night vision systems, for example, which diffuse light but also show generated real life images to help navigation. This is an example of light emission shaping the light in order to be able to have that in front of your eyes and then your brain makes sense of your surroundings. Here you can understand why miniaturization is so important. These applications are increasing the performance and reducing costs. Similar goggles can be used by a surgeon in order to see what they are doing in a body without having to completely open up the patient. At some point there will be volume requirements similar to consumer applications and the combination of miniaturization, performances and price reductions will allow it to be reused in many other applications.

Where will the photonics industry go next?

I think it will follow the miniaturization path, but there are a lot of technical problems to solve first. I think the industry will be impacted in the next 20 to 30 years. My feeling is a very large diffusion of photonic systems in package will result in a lot of different products which will be part of a machine. It is already here to some extent, when a washing machine, for example analyzes what's inside it in order to measure the water flow.

What are your group's expectations for the industry in 2023?

As I mentioned, it is a peculiar year, with the first two quarters not being so good in terms of sales but this is a decrease from a market level that has never been so high.

The last two years have been complex in terms of hiring people, in terms of investment, getting access to equipment and so on. At some point you need to take a breath in order to run again at full speed. I think these first two quarter will be the industry catching its breath in order to stabilize and make clear investment strategies.

This is linked to other activities, for example the layoffs at Amazon and Google. The layoffs were large numbers but in an industry that, last summer, was saying there were 200,000 vacancies and it was unable to hire.

In Q3, Q4, the industry will restart at speed. This will be a transition year, a year of stabilization in order to regrow.

Tell us about the Yole Group and how it came into being.

After studying microelectronics and, as an MBA graduate, working in the technology sector, I identified a gap in the market. In 1998, I set up Yole Développement (Yole being my surname, backwards). The idea was to support the commercial and technical development of customers in the semiconductor industry i.e., device makers, foundries and equipment and materials suppliers, by providing market analyses to enable them to make choices in terms of technologies and supply chain strategy.

How has the company developed?

It started as a consultancy service, but in 2002, we developed a non-customised market report arm of the business. In 2006, we began teardowns and reverse engineering to give customers a better understanding of costs and technology.

Since then, these two activities have grown in parallel, and we have grown to a workforce of 170 made up of 35 different nationalities and split into teams in 7 countries in 20 different cities. We have around 1,000 customers annually, and each year we publish around 65 market reports, reverse engineer 70 devices and conduct close to 250 teardowns of systems such as mobile phones and inverters for electric vehicles.

We are still an independent company with no external investors, which means we can select the projects we want to be involved with and remain impartial.

What are your main activities?

We provide our clients, industrial companies, investors and R&D organizations worldwide, with market research, technology, strategy and cost analysis, as well as financial advisory services.

Around 25% of our business is custom reports, covered by NDAs, which can last two days to two years. There are also market surveys and market intelligence, we focus on performance analysis to enable customers to compare technologies in terms of manufacture processes, cost and performance - especially in new systems like LiDAR, thermal, shockwave and infrared Imaging.

We also decided to spin off a company, dedicated exclusively to European projects.

Written by Carlos Lee, Director General of EPIC.

Back to Features

Back to Features