Basler AG is a leading global manufacturer of digital cameras for industrial and video surveillance applications, medical devices, and traffic systems. Founded in 1988, the company employs around 300 people at its headquarters in Ahrensburg, Germany, as well as at international subsidiaries and offices in the US, Singapore, Taiwan and Korea. NLTT Senior Editor, Andreas Breyer, sat down with Henning Tiarks, Head of Product Management at Basler AG to discuss the future of USB3.0, new markets and technology trends.

Novus Light Technologies Today (NLTT): 2012 was a challenging year for many in this industry. How did Basler’s business develop?

The first three quarters 2012 went very well for Basler. In particular the segment components, which includes cameras, saw a double-digit increase both in sales and order incomes. Incoming orders for the whole group amounted to € 44.5 million in the first nine months, a 5% increase over 2011. Sales revenues for the group amounted to € 41.8 million in the first nine months and reached the previous year's level. This led us to give a positive outlook for the fourth quarter 2012 and to raise the forecast for sales and earnings for 2012. However, as a stock listed company we have to comply with the regulations and cannot give out business data until the annual report is published.

NLTT: Basler was one of the companies that introduced USB 3.0 cameras at Vision 2012, even before the standard was officially released. What were the first reactions of your customers to these products and what are your expectations on how the standard will establish and who will use it?

Basler is one of the key players in the USB3 Vision Committee and has been pushing the USB3 Vision standard in the same way like the GigE Vision standard some years ago because we believe in the power of such standards and experienced an exceptional good acceptance by customers in the case of GigE Vision. We believe that it will be the same for USB3 Vision. Basler cameras will therefore be 100% compliant with the USB3 Vision standard. We think that vendor-specific, proprietary or interim solutions have never proved to be beneficial for customers and create more hassle, effort and costs and can even damage the reputation of an interface.

Customers see two major benefits with USB 3.0. The first and biggest advantage is the fact that they now have a solution to replace FireWire installations. These are typically older than 5 years and the lifetime of FireWire is nearing its end. Due to the extraordinary real-time capability of USB 3.0 and the DMA-functionality for low CPU load, USB 3.0 is ideal to replace FireWire. Therefore, Basler has combined the first USB3 Vision cameras based on our ace camera platform with the typical CCD sensors used in FireWire cameras to make transition as smooth as possible.

The second benefit is the increased bandwidth in comparison to FireWire or even GigE. Here is the second sweet spot that will develop over the next few years: higher bandwidth will allow faster sensors to be easily attached to the PC. Basler is already creating products for that market as well and will also fuel that trend in 2013.

To summarize: Major user groups will be former FireWire users from the industrial environment and former USB2 users who want to enjoy a stable and standardized interface and may also come from non-industrial applications such as medical, microscopy, retail and other applications. The third group contains users that look for high speed, standard resolution cameras with an easy to use and cost-effective interface.

NLTT: Besides USB 3.0, what is new in your industry and what are the trends technology-wise?

We clearly see that the trend for CMOS image sensors - that has been reported for more than 10 years - is more and more materializing in our industry and in our own business. In some industrial camera categories, CMOS has nearly fully replaced CCD sensors and we also see that CMOS has been growing much faster into the main industrial cameras market due to global shutter technology and very attractive pricing. In the lower-end industrial camera market, CMOS based cameras with small pixels and rolling shutter start to dominate the market, as well. Even in line-scan applications we can foresee that the portion of CMOS based cameras will increase fast soon.

Besides, we see that simple NIR cameras get requested more and more and conquer new applications due to their attractive cost structure based on new standard CMOS sensors.

NLTT: What do you see as the main challenges currently in your business and how do you expect to overcome them?

The overall economic situation and the unpredictability of certain developments in the markets certainly is a challenge. Overall we think Basler is well-prepared and we have already increased the number of markets we are active in such as Intelligent traffic systems, medical and other non-industrial markets to reduce dependency from certain single markets.

NLTT: What significant trends do you see emerging in the next few years in the camera segment?

The major drivers for cameras will still be size, performance and costs. This will not change too much but the task is getting more difficult since many cameras only consist of one fully packed board inside a very small package embedding one of the latest and fastest CMOS sensors. So the major task will be to find intelligent and new ways to drive down the overall size while further reducing the costs of the device. We suspect to see a race for very innovative solutions that need to be done to answer the market drivers as mentioned above. Besides that, in a 5 years’ timeframe it is likely that there could be another consumer-driven interface that will even exceed the USB 3.0 and Camera Link bandwidth and that will allow to have an easy to use and cost-effective interface even for very high bandwidth needs.

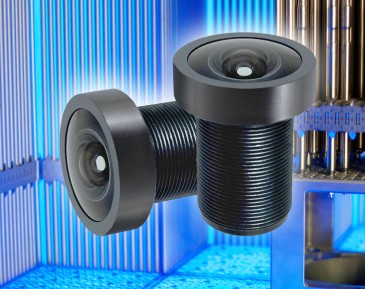

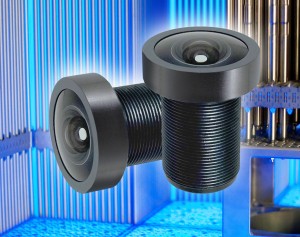

Basler ace digital camera

NLTT: Which customer segments will drive further growth of the industry in 2013?

There are lots of neighboring markets to machine vision. Besides Intelligent traffic systems and medical, which are probably the biggest nearby markets, many new markets are emerging in other fields. Basler sees markets in different areas of retailing such as reverse vending, eye care and computer aided selling. In these markets, typical cameras require a different approach in design to the customer’s need but the technical basic specifications are comparable, while the main difference is there in terms of costs for these cameras. Such applications require comparably low costs because the cameras are used in high volumes in more consumer type applications.

Lastly the major driving force to enable rapid growth in and outside the industrial market is a focus on easy integration to make it possible to apply cameras and software in many applications where they may not been used today. That is valid in terms of applications themselves but especially if one thinks about countries and territories that may not have used cameras and software so far or just start to, such as India and still parts of Asia as well.

Top Photo: The Basler ace camera series offers about 50 models with GigE, USB 3.0, or Camera Link interface.

Interviewed by Andreas Breyer, Senior Editor, Novus Light Technologies Today

Back to Features

Back to Features