Today at OFC (Optical Fiber Conference) 2022, EFFECT Photonics, a provider of highly integrated optical communication products is announcing that it signed a definitive agreement to acquire coherent optical digital signal processing (DSP) and forward error correction (FEC) technology as well as a highly experienced engineering team from global communications company, Viasat Inc. (NASDAQ: VSAT).

Viasat is a long-established player in DSP and FEC technology. With eight generations of design IP, they have a proven track record of delivering successful field deployments.

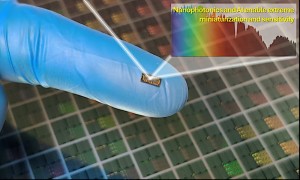

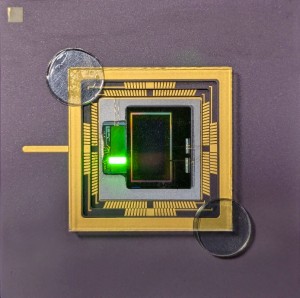

From this acquisition, EFFECT Photonics will now own the entire coherent technology stack of all optical functions, including a high-performance tunable laser, together with DSP and FEC. This will enable the Company to deliver on its ambition to make high performance coherent communications solutions widely accessible and affordable. Furthermore, it will enable longer term economic and environmentally sustainable communications due to the ability to deliver high-end performance and reach within a small footprint and with lower power consumption. This opens the way to drive coherent technology into new places, revolutionizing the way the world interconnects.

This transaction is expected to provide the following customer benefits:

- EFFECT Photonics will be able to optimize the complete solution for any application addressing both existing challenges and new possibilities

- With full ownership of the key optical, DSP and FEC functions, EFFECT Photonics can offer seamless integration, cost efficiency and security of supply

- EFFECT photonics will be an independent vendor able to offer a full portfolio of building blocks such as the tunable laser and DSP, and/or complete solutions, increasing the choice reduced by recent mergers and acquisitions in the industry

EFFECT Photonics has also secured an additional $20M in Series-C funding bringing the total to $63M. Additionally, pursuant to the DSP acquisition agreement, Viasat will be joining EFFECT Photonics’ Supervisory Board and hold a minority interest in the Company.

Back to News

Back to News