Yole Développement announced its new “Infrared Detectors Technology & Market Trends“ report authored by Yole’s Paul Danini and Yann de Charentenay, which provides a complete analysis, market segmentation and forecast by application, infrared (IR) detectors’ technology analysis and evolution. It also focuses on the latest industry news and analysis of the new market entrants and exits. The report covers IR detection, not imaging, sensors.

The total IR detector market generated revenue of more than $153 million (USD) in 2012, mostly due to the mature motion detection market, which relies on high-volume sales of automatic lighting and intrusion detection systems. However, in a scenario that includes spot thermometer function in mobile devices, these revenues are expected to reach $381 million in 2018, growing at a 16% compound annual growth rate (CAGR), fuelled by the following:

• Small detector applications, especially in consumer mobile applications. The growth in mobile applications is expected to be driven, in the short term, by the adoption of mono-pixel sensors for internal temperature measurement and spot thermometry in smart phones and tablets. Technological innovation will be key to competing with other technologies in that market. Wafer-level-packaging and seeking ever smaller form-factor sensors will be necessary to address these markets. A specific scenario for the adoption of IR sensors in mobile devices will raise market revenues in 2018 by $30 million.

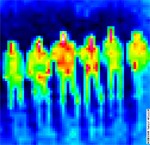

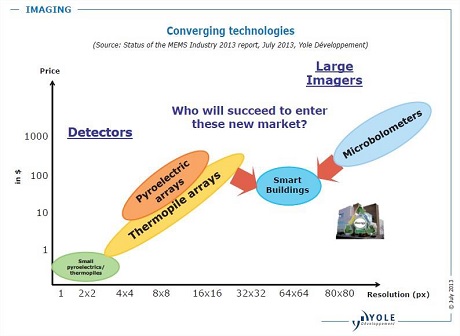

• Array detectors, which range from medium size (4×4 pixels to 16×16 pixels) to large size (32×32 pixels and above), are expected to grow at ~30% CAGR in the 2013-2018 period. Medium-size arrays have started to be successfully sold in: heating, ventilation and air conditioning (HVAC) for buildings and automotive; people-counting for retail; and home appliances. Medium-size arrays will continue to expand due to affordable pricing. Large-size arrays are expected to target the market for smart building automation, which will use a wide variety of detector functions and could support higher pricing. However, these positive market dynamics will be fuelled by detector price erosion.

Yole Développement’s report includes market insights in units and revenue by market segment and also by detector resolution. IR detector market forecasts are realised for 2013-2018. The report includes an overview of small-size IR arrays for imaging purposes.

Low-cost and easy-to-manufacture, IR detectors have been used in diverse markets, such as construction, security, appliances and industrial, and for a wide variety of functions (e.g., motion detection, temperature measurement, counting and fire and gas detection). Initially limited to single-pixel pyro-electric detectors with a basic motion-detection function, IR detectors have progressively been used in more complex systems. This has diversified the market into higher-end applications (e.g., temperature-sensing, gas and fire detection and spectroscopy).

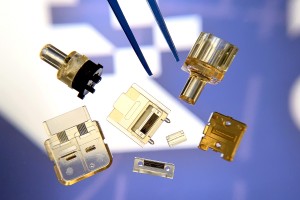

At the end of 2000, the diversification had been pushed further into the high end of the market by the introduction of array detectors. Multiple companies, led by Heimann Sensors, adopted a technology-push strategy to introduce IR detector arrays based on either pyroelectric technology or thermopile technology. Coming from the micro-electro-

However, in 2013 the domination of thermopiles has been challenged by a new entrant based on a technology coming from the IR imaging market: ULIS. The large IR detector is the first micro-bolometer having a true resolution (without windowing) below 100×100 pixels, aiming to gain market share in the developing large-size IR detector market.

The IR detector competitive landscape is complex due to the diversity of players in that market. Having a clear understanding of each player’s technological background and positioning clarifies what the total available market is and the challenges that it has to face.

While the small-size IR detector market is a commodity market driven by price, medium-size and large-size array detectors are cost and performance driven and offer room for differentiation for new entrants. However, strong barriers lie between each IR detector technology (i.e., pyro-electric, thermopiles and micro-bolometers) because these technologies are based on different manufacturing processes, making the move from one technology to another difficult without a merger or acquisition. Similarly, from a product standpoint, the move from small detectors to array detectors is challenging because it relies on strong IP or on MEMS manufacturing capacities. In this context, many companies are not in direct competition and there is still opportunity to take position in the high-potential large detector market.

Back to News

Back to News