The sun is shining on solar in the 2020s. Despite the supply chain disruptions in the underlying components caused by the COVID-19 pandemic, it represents the second-largest absolute generation growth of all renewable technologies, slightly behind wind and ahead of hydropower. According to BP, the global growth rate of solar production in 2019 was 24.3%, with the rate rising to 33.2% in non-OECD (Organization for Economic Cooperation and Development) countries. Many studies indicate that this growth rate will continue, thanks to government policies, falling costs, and rising demand which have all driven considerable growth rates around the world.

Rising energy demand coupled with a growing population and the rising price of non-conventional energy is expected to drive the market for solar power in the coming years. Government initiatives for the use of renewable energy, low maintenance and low operating costs, combined with rapid industrialization in developing countries are bolstering the global market for solar energy.

United States government previously stated plans to cut the cost of electricity generation by 50% by 2030. The current administration announced that 100% of energy production in the US will be carbon-free by 2035. Many states, including California, and New Jersey, have set their own solar energy targets for 2030, and are expected to create several opportunities for the United States solar energy market in the future.

While policies and climate events have increased interest in solar power, it’s the dramatic fall in price that has enabled this dramatic growth.

The cheapest electricity in history

According to International Energy Agency’s World Energy Outlook 2020, no other power-generation technology matched solar’s pace this past decade, resulting in the “cheapest…electricity in history” with the technology cheaper than coal and gas in most major countries.

With governments, private industry, and consumers all seeking energy sources that are greener but still affordable, solar cell manufacturers are under pressure to increase the quality of their products and reduce costs. Improvements to solar panel manufacturing over the last decade has been a key driver in this downward cost. Scaling up production while integrating new technologies demands more automation and quality control, as yield is critical.

Complex assembly

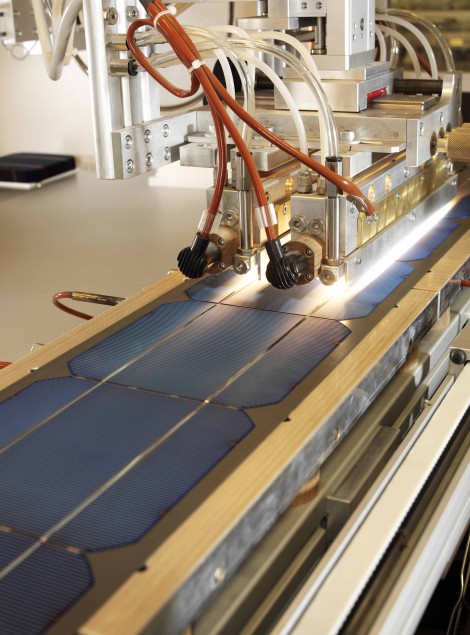

Simultaneously, as technologies are more established, and demand is climbing quickly, expected volumes are up, and margins are down. As we’ve seen in other industries, this makes the efficacy of the production line absolutely important. Exacerbated by workforce limitations under COVID-19, many manufacturers are investing in more automation including robotics for assembly and advanced imaging for inspection.

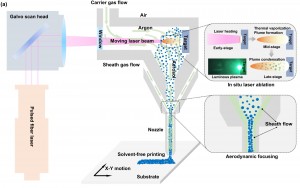

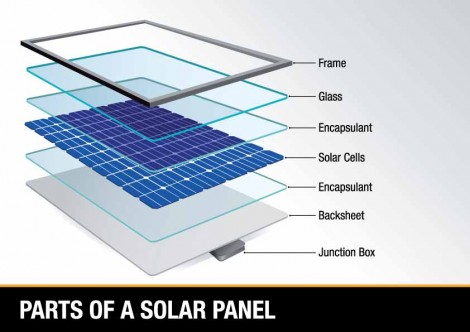

Automation and inspection are both critical to high-quality, consistent, and high-throughput solar panel manufacturing. There are delicate components and multiple layers, all requiring precise placement and alignment. Material handling, cell cutting, and component bonding are all very automated in modern factories, but an error in any one of them risks lower initial performance, and shorter operational life for each solar panel.

This makes inspection crucial. End-of-line testing of electrical parameters like current voltage and peak power rating ensure that panels perform at expected standards. Imaging allows us to look for quality issues, such as cracks and misalignments that indicate initial quality, but also longevity of the panel itself in the field.

Like many areas of electronics manufacturing, leading manufacturers have already moved to 100% inspection and the rest of the industry is working to catch up. Optical inspection is a requirement at every major processing step.

Assembly Layers of a Solar Panel. Manufacturing each panel requires precise layering of glass, semiconductors, metals, and coatings, subjecting them to many etching, bonding and electrochemical steps.

A single crack can tell the future

Chasing efficiency, modern silicon solar cells are getting thinner, in some cases approaching 100 microns. Thinner and cheaper also means more fragile. Each stage of production creates an opportunity for tiny cracks to appear. For example, after soldering the copper in connecting wires will contract, pulling away from the silicon boards they’re connecting, causing small cracks. Cracks can also occur at the crystal growth stage, or during cutting.

Any imperfection in solar cells, such as cracks, poorly soldered joints, and mismatches, lead to higher resistance and become hot spots in the long run. The long term effects of hot spots include burnt marks that degrade solar cells and back sheets and may eventually lead to fires if left unchecked.

Imperfections in the glass layer can make cells more susceptible to breakage. Whole production lines are stopped by contamination from shards from broken wafers or glass. Once installed, the front glass panel of a solar panel provides the first line of defense against the elements: storms, dirt, and even a stray baseball. If the glass is broken, the panel will absorb and convert less light. In addition, other contaminants, such as water and dust can penetrate the panelcausing more problems and undermining the integrity of the entire panel.

Further mechanical stress from transport, installation, or weather can cause these initial issues to propagate. So it is critical to identify and remove damaged or imperfect parts from the production process to prevent faulty products.

Imperfections in the glass can lead to weaknesses to environmental hazards such as hail and debris.

Factory floor realities

In 2021, machine vision is a key tool that manufacturers use to improve product quality and production efficiency while increasing the pace of product to meet demand. The challenge is detecting these submicron defects that are not yet problems, but will cause failures, yield reduction, and material damage down the road.

CCD- and CMOS-based cameras have been long used to detect microcracks on the assembly line. Even with cooled sensors, these systems can require long integration times in very dark conditions, slowing down the production line and introducing additional complexity. The latest high resolution, high speed line scan and TDI cameras now find extensive use in solar panel manufacturing.

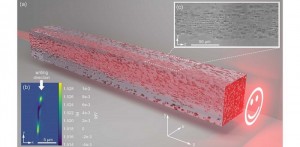

Indium gallium arsenide (InGaAs) detectors are sensitive to NIR/SWIR wavelengths where the silicon substrate becomes transparent, reducing light scattering. Manufacturers will typically apply voltage to the cells to make imaging easier: silicon and other photovoltaic cell materials will emit light that the LWIR sensors can reliably see, even at video rates. This helps manufacturers spot flaws in the top layers – from the optical layers down to the photodiode junctions in the cells.

For example, LWIR imaging can detect temperature differences between parts of the module or between modules. Broken junctions cause inactive areas – and because they are not converting energy to DC power as designed, they produce more heat, slightly raising the temperature of that specific area enough for a camera to see. These are the kinds of defects that could lead to hotspots, decreased performance, and even fires years later.

This kind of scanning can also help identify cells that meet certain efficiency levels, allowing them to be matched with similar cells. This ensures that single cells are not holding back the power output of the whole module or panel.

No matter the type of imaging used in inspection, system performance is an important determinator of the success of the system – in terms of both speed and accuracy. Higher pixel counts, better contrast, dynamic range, lower noise, quantum efficiency, higher speeds, and precise system installation translate directly into better quality control and feedback on the manufacturer line.

Future developments

There remain many directions for future developments. Cost and reliability will certainly lead. Both factors can go hand-in-hand, which is why the US government is funding research to more than double the expected lifespan of solar panels, which currently sits at around 25 years.

New materials offer opportunities, as well. Today almost 90% of solar panel cells are made from crystalline silicon, but that might be changing soon. Organic photovoltaics panels are particularly promising - the base materials are abundant, and chemical synthesis is simpler. They are also much lighter, providing new possibilities for placement. They could even be printed! While they have yet to meet the performance levels of tried-and-true technologies, it seems that they could represent the future of solar panels. Compared to crystalline silicon solar module, which has an emission spectra peak at 1150nm, organic cells peak at slightly longer SWIR wavelengths (1200nm – 1400nm).

Climate change will continue to drive and shape solar demand in surprising ways. In Australia, aging fossil-fuel infrastructure has helped retail electricity prices to nearly double since 2005. In California, rolling blackouts to prevent forest fires affect most of the state in the summers. In Texas and Puerto Rico, extreme weather events damaged infrastructure and called into question the reliability of the whole electrical grid. In response to all of these events, both companies and individuals have driven a surge of interest in solar-driven systems that can fill the gaps created.

As old problems are solved, new ones arise. The result is a dynamic industry with enormous long-term potential. While it might be said for almost any industry, it is more true for solar power: it could make the world a better place.

Learn more about imaging for solar cell inspection here.

Written by Mike Grodzki, Product Manager, Teledyne Imaging

Back to Features

Back to Features