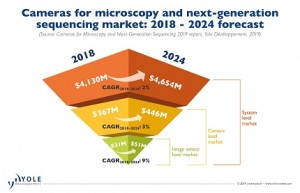

“Microscopy & NGS markets are undergoing enormous technological changes”, announces Marjorie Villien, PhD. Technology & Market Analyst at Yole Développement (Yole).“These innovations are opening the way for new business opportunities, especially within the camera image sensors industry.”

Indeed, one of the most remarkable changes is the introduction of disposable image sensors within the cameras for microscopy & NGS. In this dynamic context, the market research & strategy consulting company announces 18% CAGR in volume between 2018 and 2024... In this dynamic context, Yole announces today its relevant technology & market analysis, Cameras for Microscopy & NGS (next-generation sequencing).

This report delivers the historical perspective and synergies with other markets, market data and forecasts at system, camera, and image sensor level, by segment and technology. It also presents a detailed description of the technology penetration and market trends, per segment. Finally, Yole’s analysts propose, with this new imaging report, a comprehensive overview of the supply chain and its evolution.

What is the status of the microscopy & NGS markets? How will the cameras industry evolve within these applications? Could we see new business models within the overall microscopy & NGS supply chain, due to the trend toward disposable image sensors in the consumables? Yole has developed a relevant imaging & medical expertise with the publication of numerous reports including Status of the CMOS Image Sensors Industry, NGS & DNA Synthesis: Technology, Consumables Manufacturing and Market Trends and more.

Today analysts combine their knowledge to deliver an impressive analysis of the cameras industry for microscopy & NGS applications.

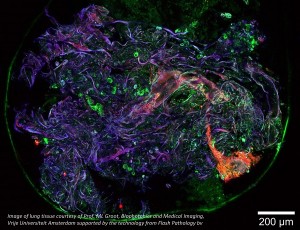

Cameras are key elements in the microscopy and NGS space. Indeed, today most microscopes are digital microscopes that use at least one (and sometimes more) cameras.

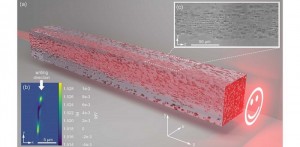

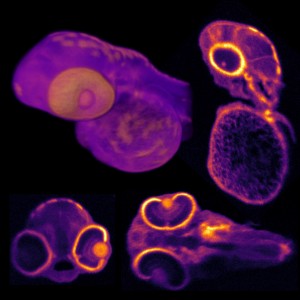

“The main trend in optical microscopy is to attain higher resolution, as well as faster acquisition and higher sensitivity for quicker and better diagnostics, and real time imaging of living organisms,” explains Marjorie Villien from Yole. “CCD is the main image sensor technology used today, but CMOS is gaining market share due to an increasing need for high-speed image acquisition.”

However, this trend towards better imaging is counterbalanced by another trend – one that leans towards portability and use of microscopy at the point of care. These systems are sleeker and cheaper, and deliver microscopy results directly to the caregiver.

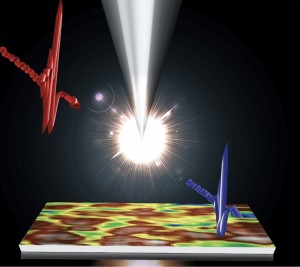

This is also the case for NGS. Two very different trends are discernable, one towards higher throughput with very expensive, bulky equipment; and another that is lower throughput, with cheaper equipment offering lower footprint and wide availability.

Illumina, the optical NGS market leader with more than 80% market share is a good example. The company has a diverse product portfolio of mid- to high-end systems, but recently launched a more affordable, lower-throughput system – the iSeq100. This follows the trend towards commoditization of NGS. The iSeq100 does not integrate optical systems in the instrument anymore, but uses a disposable image sensor directly inside the flow cell, which is a game-changer in the NGS market! Indeed, this makes the instrument much more affordable, enabling Illumina to place more systems and therefore sell more consumables, which they can make cheaper because of increased volumes.

This trend is also seen with BGI, Illumina’s Chinese competitor, which recently announced a benchtop, optics-free NGS instrument running CMOS chips.

The new Cameras for Microscopy & NGS report describes the technology evolutions in the microscopy and NGS fields, and the effect these developments will have on the market and ecosystem. A detailed description of this analysis is available on i-Micronews.com.

Back to News

Back to News